Gaston signs Definitive Agreement to acquire producing Copper assets in Bolivia

Dubai, UAE – 04 August, 2025: Gaston International DMCC (“Gaston”), part of Jemora Group is pleased to announce that it has entered into a binding share purchase agreement (the “Agreement“) with 昆明星耀矿业投资有限公司 Kunming Shining Star Mining Investment Co. Ltd. (“KM Shining Star” or the “Vendor”) and Shining Star (HK) Mining International Investment Co., Limited (“HK Shining Star”), for the proposed acquisition of all issued shares of HK Shining Star (the “Transaction“) and its Bolivian subsidiaries.

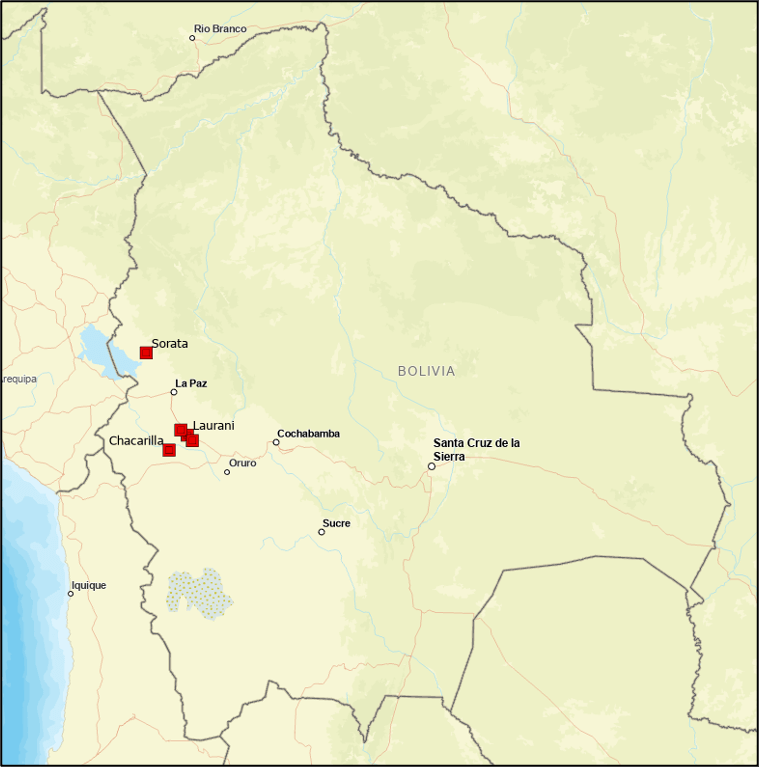

Under the Transaction, Gaston will acquire HK Shining Star’s mining interests in the Chacarilla copper mine, its fixed assets and property (“Chacarilla Copper Mine”), as well as exploration licences for the Thaya Montana Laurani Polymetallic project (“Laurani Project”) and the Sorata Polymetallic project (“Sorata Project”).

Key Highlights:

- Gaston has entered into a binding share purchase agreement for the acquisition of 98% interest, free of debt, in the Chacarilla Copper Mine, located in Bolivia.

- The Chacarilla Copper Mine encompasses:

- An NI43-101 Indicated Resource of 4.5 million tons at 2.99% Cu, for about 135,000 tons of Cu contained

- A developed underground mining operation with a processing capacity of 500 tons per day

- Considerable exploration upside is considered to exist within the Chacarilla Copper Mine property and new tenement applications.

- Gaston plans to rapidly carry out a Feasibility Study for a 1,500 tons per day underground copper mining at the Chacarilla Copper Mine

- In parallel with the Feasibility Study, Gaston will implement an exploration program aimed at assessing the potential for an increase in the mineral resource estimate

The Laurani and the Sorata Polymetallic Projects provide additional potential to increase further Gaston’s resource base in Bolivia

Dev Shetty, Gaston International’s Founder and CEO, says, “We are pleased to announce the acquisition of the Chacarilla Copper Mine in Bolivia’s Corocoro Basin, widely recognised for hosting some of Bolivia’s richest copper mineralisation. This near production mine aligns with Gaston’s strategy of acquiring highly potential mines with clear geological upside and immediate development.

KM Shining Star, which has successfully explored and developed the site over the past five years, has entrusted Gaston with advancing the next phase of the mine’s lifecycle. Their groundwork provides us with a strong foundation for operational ramp-up and long-term growth.

This acquisition—alongside additional acquisitions in our pipeline—positions Gaston to deliver exceptional value in the Energy Transition, Precious Metals and Gemstone sectors. As part of our broader regional strategy, we see the United Arab Emirates emerging as a vibrant hub for sustainable mineral sourcing, driven by high-yield projects and world-class technical execution”

Derrick Zhang, CEO of Shining Star Group’s Mining Segment, says, “We are thrilled to collaborate with Gaston and its seasoned technical team on the next phase of development at the Chacarilla mine. This NI 43-101 compliant copper asset already hosts a 500-tonne-per-day processing plant, and with a newly delivered 1,500-tonne-per-day facility, we are well positioned to scale production significantly. With electrification to the national grid complete and underground mining now underway, Chacarilla is emerging as a cornerstone of Bolivia’s copper sector. We are deeply grateful for the continued support of the surrounding community, our strategic partners, and the Bolivian government”

About Gaston International (“part of Jemora Group”)

Gaston is part of Jemora Group, a Dubai-based conglomerate specialising in metal and mining investments, trading precious metals and gemstones, and operating a gemstone auction house. Gaston’s vision is to position the UAE as a key hub for mining investment, with a particular emphasis on the Energy Transaction, Precious Metal, and Gemstone sectors. Gaston invests in funding pre-feasibility, feasibility, construction, turnaround scenarios and operating mines.

About KM Shining Star (“part of Shining Star Group”)

KM Shining Star is part of Shining Star Group, which was established in 1993 in Yunnan Province, People’s Republic of China. With a total asset of nearly USD 3billion, it employs over 4,600 staff across 10 subsidiaries involved in mining, salt, chemical, commercial management, property management, hotels, automobiles, manufacturing, hospitals, real estate development, sports, and support services. Its development and investment projects are in Shenyang, Qingdao, Tianjin, Kunming, Dali, Songming, Hong Kong, as well as in Myanmar, Cambodia, Uganda, Angola, Bolivia, and other countries and regions in Southeast Asia, Africa, and South America.

Advisors

Minmetal Securities Co., Ltd, a wholly owned subsidiary of Minmetals Capital Holdings Co., Ltd., served as the exclusive financial advisor for this transaction, and DLA Piper (Canada) LLP acted as legal counsel to Gaston.

Contact: Gaston International DMCC

www.jemoragroup.com

Dev Shetty, Founder and CEO

dev@gastonint.com

Acquisition of the Copper asset from HK Shining Star

HK Shining Star is the registered and beneficial owner of:

- 98% of the issued and paid-up share capital of EMYL. EMYL holds 99% of Empresa Comunitaria Minera Chacarilla S.R.L (“ECMC”). EMYL directly or indirectly, through ECMC, holds mining interest in the Chacarilla Copper Mine.

- 98% of the issued and paid-up share capital of EMTM. EMTM holds one exploration licence in connection with the Laurani Polymetallic Project; and

- 98% of the issued and paid-up share capital of EMCA. EMCA holds three exploration licences in connection with the Sorata Polymetallic Project.

Each of EMYL, ECMC, EMTM and EMCA is a company incorporated under the laws of Bolivia. The minority interest in each of these entities is held by individuals in compliance with local laws. The Vendor will be paid a combination of cash consideration, share consideration of relevant listed companies and 3% royalty over the life of the mine, with Gaston having an option to purchase 1% back from the Vendor.

The Transaction is subject to on the fulfilment or waiver of various conditions, including obtaining all necessary consents, authorisations, orders, or other required approvals, the signing of a royalty agreement, and other standard conditions for a transaction of this kind.

The Chacarilla Copper Mine

The Chacarilla Copper Mine is located approximately 177km or 120km of straight stretch south of La Paz, Bolivia, under the jurisdiction of the Municipality of Chacarilla Villarroel Province, La Paz Department, at an elevation of about 3,900m amsl.

The Chacarilla Copper Mine is held under two contractual mining interests with a total area of approximately 25 km2, and two contractual mining interest applications totaling 27.5 km2. The Chacarilla Copper Mine comprises an existing underground mining operation as well as surface infrastructures, including a processing plant with a 500 tons per day capacity, and a new 1,500 tons per day plant under construction

An NI43-101 Technical Report was prepared in October 2024 and includes the following mineral resource estimate. The report was prepared by Dr Bing Zhou and Dr Siwei He of Jiawei Technologies (Canada).

| Category | Tonnage (t) | Cu grade (%) | Cu contained (t) |

| Indicated | 4,514,100 | 2.99% | 134,900 |

| Inferred | 1,369,100 | 2.68% | 36,700 |

The mineral resources are quoted at a 1.5% Cu cut-off grade and have been rounded. The database used to prepare the mineral resources includes 159 boreholes (66,358m), 1,841 assay samples and 30 surface trenches with assay samples of 60.9m.

The Chacarilla Copper Mine deposit is a typical red-bed sandstone-hosted copper deposit with strong stratigraphic controls. It is part of the Andean orogenic belt, located at the northern end of the Andean Cordillera. Nearby are the Carapi, Faja, and Corocoro copper mines.

The main ore body is about 2.8km long, extends in a northwest-southeast direction, dips southwest and is open in several directions. It is located on the southwestern wing of an anticline, with potential for more ore on the northeastern wing.

The region has seen minimal modern exploration since the 1970s, and Gaston believes that the Chacarilla Copper Mine has substantial potential for a significant increase in the mineral resources estimate.

Laurani and Sorata Polymetallic Projects

The Laurani Polymetallic Project is located 37 km from Chacarilla Copper Mine (in a straight line) and 40 km northwest of the Kori Kollo mine which has historically produced 167 tons of gold and 907 tons of silver. Identified mineralisation at the Laurani Polymetallic Project corresponds to a high sulfide epithermal Au-Cu deposit. The geology of the project area also suggests strong potential for porphyry deposits for gold and silver.

The Sorata Polymetallic Project is located 84 km northwest of La Paz, and just 10km from the Yani Gold Mine. The project is located on a mineralised belt extending in a northwest-southeast direction over several hundred kilometers, marked by numerous hydrothermal vein-type gold, copper, tungsten and tin deposits.

Figure 1 – Map of Bolivia with the location of the Chacarilla Copper Mine and of the Sorata and Laurani projects

Cautionary Notes

This news release contains forward-looking statements. These statements include statements regarding the Agreement, the Royalty Agreement, the timing of closing, the payment of the consideration, the parties’ ability to satisfy the conditions to closing the Transaction, the expectations for the projects, and plans and objectives. These statements are based on current expectations and assumptions that are subject to risks and uncertainties. These statements involve known and unknown risks, uncertainties and other factors that may cause actual financial results, performance or achievements to be materially different from the estimated future results, performance or achievements expressed or implied by those forward-looking statements, and the forward-looking statements are not guarantees of future performance. Accordingly, readers should not place undue reliance on forward-looking statements or information. We do not assume any obligation to update any forward-looking statements.